Welcome to Rent Economics: we analyze apartments rent data to understand the economics of where we live, to explore how housing intersects with finance, investment, and society.

Spain has emerged as a frontline in Europe’s intensifying conflict over short-term rentals (STRs), where the clash between economic gains from tourism and escalating housing unaffordability is coming to a head. With STR supply expanding rapidly—often outpacing hotel growth—local communities are increasingly vocal in their opposition. Last weekend’s anti-tourism protests, stretching from Barcelona to the Balearic Islands, signal a broader public reckoning with the spatial and social costs of platform-driven tourism.

At the same time, national and municipal governments are tightening regulations, from mass delistings on Airbnb to new tax regimes and permit restrictions. As Spain grapples with a housing shortage estimated at 450,000 units and rent spikes in tourist-saturated areas, the debate over STRs reveals deep structural tensions in the country’s economic model—where the right to housing now contends with the imperatives of global leisure demand.

The Map

Chart 1: Revenue from Aprtments to tourists

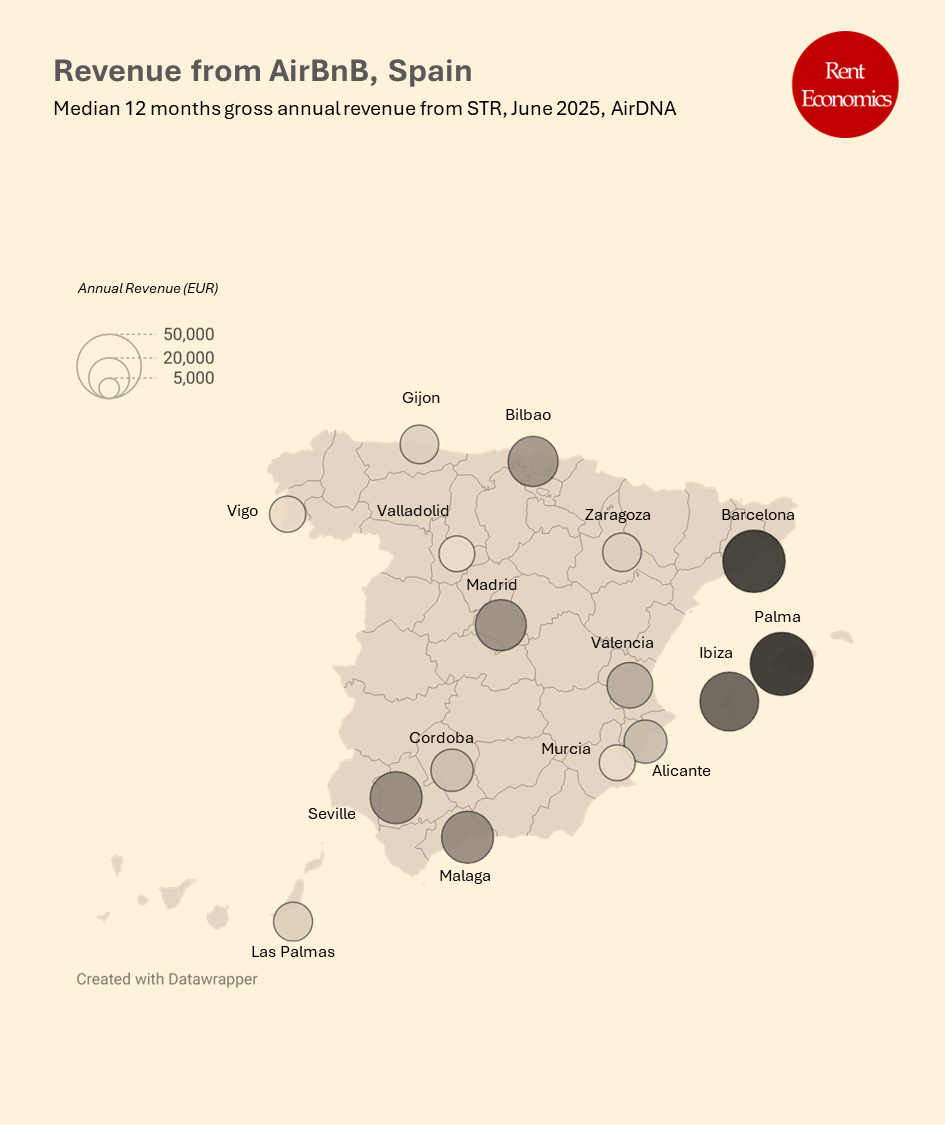

This chart visualizes the median gross annual revenue from short-term rentals across major Spanish cities as of June 2025, based on AirDNA data. The spatial pattern is clear: coastal and island markets dominate in profitability, with Palma, Barcelona, and Ibiza standing out as the highest-revenue zones—each delivering over €40,000 per listing annually.

Inland and northern cities like Valladolid, Zaragoza, Gijón, and Vigo show significantly lower income potential, highlighting how geographic tourist concentration directly shapes the STR economy. These disparities also reflect broader demand-side forces: seasonality, international tourism flows, and pricing power.

This geographic clustering of high returns is a key reason local administrations in coastal cities are leading the regulatory crackdown—the economic upside for hosts is enormous, but so are the social costs for residents.

Chart 2 and 3: Rates for Ibiza and Palma in a League of Their Own

This chart ranks Spanish cities by their average daily rate (ADR) on Airbnb over the past 12 months. The findings confirm what many locals already feel: staying in Spain’s top destinations isn’t cheap.

At the top of the list, Ibiza leads with a staggering €276 per night, followed by Palma (€229) and Barcelona (€188). These rates rival or exceed many luxury hotel markets in Europe and reflect not just demand but supply scarcity—especially in island settings where hotel development is constrained.

Mid-tier cities like Bilbao, Seville, and Málaga fall into the €130 range, while inland and less tourist-saturated areas such as Valladolid, Murcia, and Zaragoza remain below €100.

The ADR stratification reinforces a core economic dynamic: pricing power is highest where tourism is most concentrated and housing markets are tightest. For landlords, the incentives to convert long-term rentals into STRs in these cities remain strong—despite rising regulation.

Chart 3: Seasonality

This panel of time series charts tracks Airbnb daily rates over the past 12 months, showing the seasonal pulse of Spain’s short-term rental market. The picture is unmistakable: Ibiza and Palma are highly seasonal markets, with nightly prices surging during summer months—especially between May and August—and plunging in the off-season.

Ibiza’s rates, in particular, peak well above €350/night, highlighting how a few high-demand weeks can drive a disproportionate share of annual revenue. Palma follows a similar but slightly smoother pattern, with prices rising steeply into spring 2025.

In contrast, cities like Madrid and Valencia exhibit far flatter seasonal curves. Here, STR revenues are driven more by consistent occupancy than by pricing spikes—reflecting year-round urban tourism, business travel, or domestic demand.

The seasonal volatility reinforces the attractiveness—and risk—of STRs: in hot markets, timing is everything. But it also raises urban planning questions. In cities dominated by high-summer peaks, housing units may sit empty much of the year, underused by both tourists and locals.

Chart 4: Occupancy

Occupancy is often the most reliable signal of sustained tourist demand—and this ranking reveals which Spanish cities keep their Airbnb calendars the fullest. Barcelona tops the list with a 75% occupancy rate, reflecting its enduring global draw and dense year-round tourism economy. It's followed closely by Málaga (74%), Seville (72%), and Valencia (71%)—all southern cities where strong climate, cultural appeal, and digital nomadism drive consistent bookings.

Interestingly, Palma and Ibiza, despite commanding the highest daily rates, show lower occupancy (63% and 59%) due to their heavy seasonality. They earn outsized annual revenue during short peak periods but sit largely empty off-season.

At the bottom, inland and less internationally trafficked markets like Zaragoza, Gijón, and Valladolid register occupancy below 55%. These cities face less pressure from overtourism, but also offer less upside to hosts—pointing to a geographically uneven STR economy, concentrated in places with consistent or premium tourist demand.

For policymakers, occupancy is more than a metric—it’s a proxy for tourist saturation and housing displacement pressure. High-occupancy cities are where the STR-to-housing tradeoff is most acute.

Chart 5: Occupancy and Rates together

This bubble chart plots Spanish cities by their average daily rate (vertical axis) and occupancy rate (horizontal axis), with bubble size reflecting median annual revenue. It offers a snapshot of each market’s position in the STR value landscape—and the results are striking.

Only Barcelona and Palma land in the upper-right quadrant, combining high occupancy and high pricing power, making them the most economically potent STR markets in the country. These cities also face the fiercest regulatory pressure—Barcelona, in particular, has already committed to phasing out STR licenses entirely by 2028.

Ibiza is a different story. It boasts the highest prices but only moderate occupancy (59%), making it a classic case of luxury tourism driven by exclusivity and seasonality. Its oversized revenue bubble shows that even with lower utilization, pricing can sustain strong returns.

Elsewhere, we see two dominant patterns:

Cities like Seville, Valencia, Bilbao, and Málaga show strong occupancy but more moderate rates—ideal for hosts optimizing for consistent bookings.

A large cluster of inland and northern cities sits in the bottom-left quadrant: lower rates, lower occupancy, and smaller returns. These markets offer limited revenue upside and are less likely to face regulatory scrutiny.

This segmentation helps explain why regulation is not just a political question, but an economic inevitability: where STRs are both expensive and full, the pressure on housing is greatest—and so is the pushback.

Chart 6: Supply of Apartments on Airbnb

This chart ranks Spanish cities by the number of active Airbnb listings, providing a clear sense of where the short-term rental footprint is most concentrated. Madrid leads with over 10,000 listings, followed closely by Barcelona and Málaga, each hosting more than 8,000 active units.

These figures are especially striking when viewed in relation to local housing stock. In tourist-saturated neighborhoods, STRs can account for over 1 in 5 homes—contributing significantly to rental scarcity and gentrification pressure. This density is a major reason why cities like Barcelona are moving to eliminate STR licenses altogether by 2028, and why Madrid has imposed new restrictions on use and licensing.

Medium-sized cities such as Valencia, Seville, and Palma also show substantial volumes—ranging from 3,000 to 5,000 listings—despite having much smaller urban populations. This suggests a higher STR-per-capita ratio, amplifying their local housing impacts.

In contrast, northern and inland cities like Zaragoza, Valladolid, and Gijón remain under 1,000 listings, aligning with their lower tourist draw and smaller STR economies.

As Spain moves toward nationwide registration and stricter licensing, these supply concentrations will likely define the front lines of enforcement—and where the tension between housing rights and tourism economics will play out most acutely.

Final Thoughts

Spain stands at a crossroads. On one hand, tourism fuels over 12% of the country’s GDP, sustaining thousands of jobs and small businesses. On the other, the explosive growth of short-term rentals has deepened a housing crisis that now affects not just the poorest, but the middle class—especially in cities and islands where STR profitability far outpaces local wages.

The data show why regulation is no longer optional. In cities like Barcelona, Palma, and Ibiza, STRs are not fringe players—they are core drivers of housing dynamics. And as returns remain high, enforcement will need to move beyond fines to real caps and alternative incentives for long-term rentals.

Yet Spain’s experiment also raises a broader question: can cities remain livable for residents while remaining open to the world? The answer will depend not just on how platforms like Airbnb adapt, but on whether governments can realign housing supply with social priorities—before the next protest hits the plaza.

This was all for this edition of the Rent Economics, subscribe for future updates and comment with your feedback.

Excellent article. Being here in Valencia we see the effects directly. As an agency we stopped dealing with investors for Airbnb last year as our little grain of sand.

One thing I'd add, the most expensive place isn't in there is it? San Sebastian?

This is really fantastic, thanks a lot.