June 2025 Airbnb Data Review | Source: AirDNA

As the Gulf Cooperation Council (GCC) economies diversify beyond oil, short-term rental (STR) platforms like Airbnb are gaining ground as both a tool for tourism development and a new frontier in real estate investment. Nowhere is this more evident than in Dubai, where the STR market is not just thriving—it’s dominating. This episode explores Airbnb’s footprint in the Gulf, drawing on fresh data from AirDNA to map the scale, growth, and returns of STRs across the region.

Mapping Airbnb in the Gulf

Dubai’s role as a STR hub is geographically central and economically dominant. As this stylized topographic map suggests, STR density is heavily skewed toward the UAE, with a strong secondary presence in Saudi cities like Riyadh and Jeddah. Cities like Doha, Muscat, and Ajman are visible but comparatively nascent in their STR evolution. The geography of listings aligns with tourism, infrastructure, and regulatory openness—factors that currently give Dubai a competitive edge.

Total Listings, June 2025

According to AirDNA, Dubai hosts over 52,000 active Airbnb listings—more than double Riyadh’s 21,700. Other cities trail far behind, with Jeddah (5,300) and Abu Dhabi (3,600) showing moderate traction. The disparity points to Dubai’s first-mover advantage and strategic positioning as both a tourism and investment hotspot. Yet, the relative volume in Riyadh signals the rising ambitions of Saudi Arabia’s Vision 2030 and a maturing appetite for STRs beyond the UAE.

Dubai’s STR Surge

Dubai's listings have grown steadily over the past two years, peaking around early 2024 with nearly 30,000 monthly active units. Year-on-year (YoY) growth surged near 40% during this period, reflecting not just supply-side expansion but sustained demand. While recent months show some moderation in both listings and YoY growth, the long-term trajectory remains upward. Dubai’s success reflects favorable regulation, strong tourism infrastructure, and global investor interest.

Seasonality in Rates Across the GCC

Daily rates on Airbnb fluctuate with seasonal tourism cycles. Dubai and Doha exhibit clear end-of-year peaks, likely tied to winter tourism and events, while Riyadh and Abu Dhabi maintain flatter but stable patterns. Sharjah shows erratic rate behavior, hinting at a less mature or more volatile market. Lower-tier cities like Muscat, and Ajman show limited rate dynamics—either due to low demand or a more commodified rental market.

June 2025: Average Daily Rates (ADR)

Dubai leads the GCC in average daily Airbnb rates at $199, followed by Doha ($161) and Abu Dhabi ($155). In contrast, listings in Muscat and Ajman average just $72 and $71, respectively. These disparities reflect not only variations in tourist draw but also property quality, regulatory environments, and host strategies. The high ADRs in Dubai suggest it has succeeded in attracting premium international clientele willing to pay above regional norms.

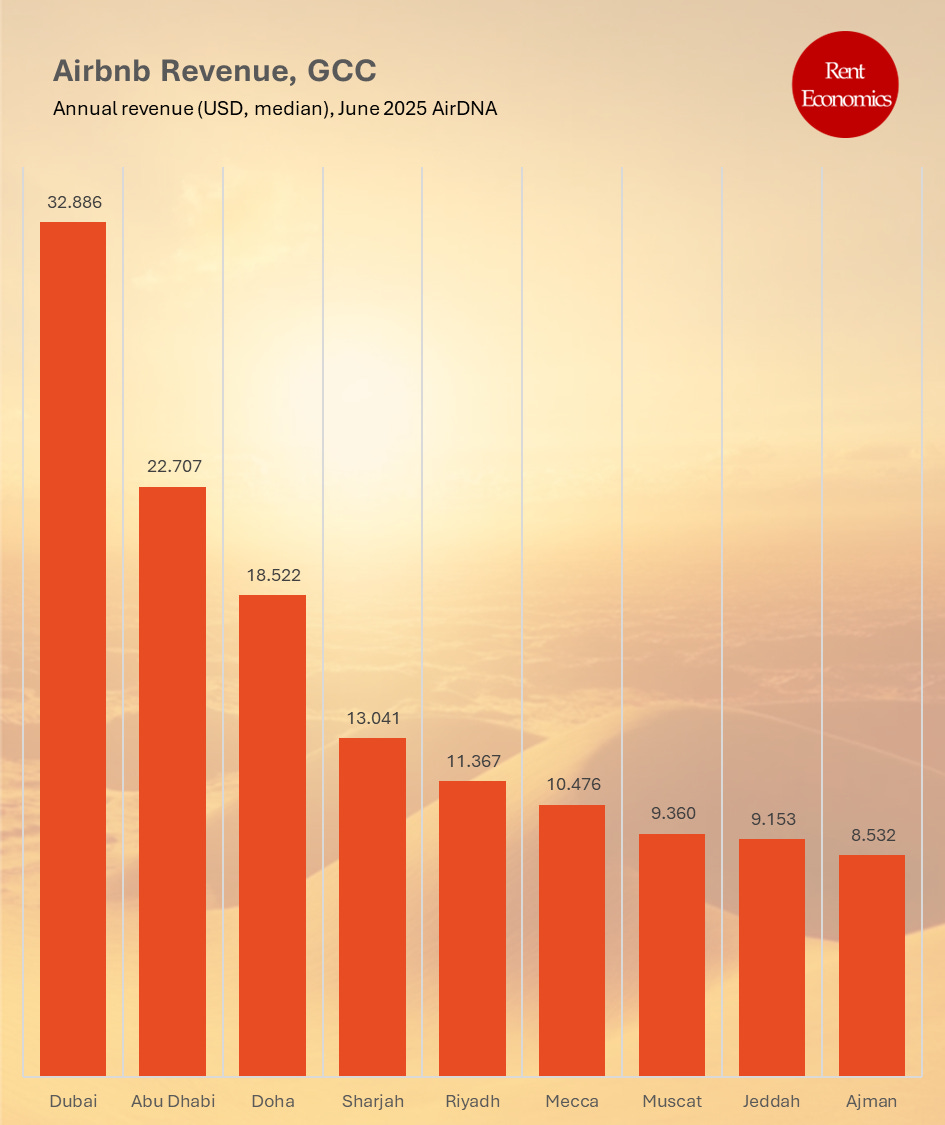

Median Annual Revenue, June 2025

STR hosts in Dubai are seeing the highest returns in the region, with a median annual revenue of $32,886 per listing—more than triple that of cities like Jeddah or Ajman. Abu Dhabi ($22,707) and Doha ($18,522) also offer strong yields, reinforcing their status as emerging STR investment targets. Notably, Riyadh and Mecca fall mid-range despite large listing volumes, suggesting either lower occupancy or pricing ceilings in those markets.

Thanks for reading Rent Economics. Subscribe for more updates on the global STR market.